On 21 May Rhenman & Partners took the opportunity to celebrate 15 successful years by inviting guests to a seminar in Stockholm. The article below is a summary of the day and captures the key messages from each presentation. Click here to read or download the article as a PDF.

Rhenman & Partners celebrates 15 successful years

Text: Karyn McGettigan

Rhenman & Partners Asset Management was established in 2008 and has been managing the portfolio of a niche hedge fund since 2009. This year the firm is taking the opportunity to celebrate the 15-year anniversary of both. The Rhenman healthcare fund specializes in investments within the healthcare sector and across the biotech, pharma, healthcare services, and medtech subsectors. Rhenman & Partners’ team of professionals has helped the firm invest approximately 800 million dollars in a portfolio consisting of over 100 highly innovative companies, which offer drugs and devices helping to improve the quality of life for people all over the world.

In March of last year Teresa Isele took over the helm as the new CEO and now leads Team Rhenman. With a strong background in finance and an understanding of global markets, Teresa is poised to take Rhenman & Partners into its next phase of growth and innovation. Teresa says: “It was important for us to celebrate these past 15 years. When I joined the company in March last year, I was touched by the warm work environment set by the three founders, Henrik Rhenman (CIO) and now retired Göran Nordström and Carl Grevelius.

“I am keen to foster the company culture set by them, where sector expertise is combined with a deep level of respect and passion for what we do.” – Teresa Isele, CEO

Looking ahead, she says: “I am keen to foster the company culture set by them, where sector expertise is combined with a deep level of respect and passion for what we do. We continue to be committed to deliver strong long-term returns for investors by investing in a sector that is vital for good health and well-being across the globe. I am proud to be a part of that.”

Teresa’s fundamental way of doing business reflects the three founders’ approach: Balancing work and play, and conducting all matters of business with the same down-to-earth values of honesty, dedication, hard work, and commitment. This is how Rhenman & Partners functions and is what has guided them through 15 successful years.

Teresa’s statement echoes the feeling at the celebratory event hosted in Stockholm in May. Employees, guests and family members alike mingled, exchanged ideas, and shared interests in the information the Rhenman team provided.

The celebration commenced with moderator and financial journalist Henrik Mitelman, energizing the crowd with a hearty welcome and setting the tone for an exciting day of camaraderie and shared accomplishments. As the regular host of the firm’s webcast and podcast, Mitelman is like a faithful fixture at Rhenman & Partners.

Guests were treated to inspiring and educational speeches from the firm’s team. The new CEO was the first to speak.

Teresa inspired the audience with an introduction to some of the greatest medical advancements in history. She explained how our desire to live longer, healthier lives has driven incredible innovations: from early herbal remedies to modern scientific breakthroughs. Teresa mentioned many instrumental game-changers in healthcare, such as penicillin, X-rays, and the pacemaker. Then she specifically highlighted two advances that show how one development often leads to many further incremental advances: vaccines and monoclonal antibodies. Vaccines have saved at least 154 million lives over the past 50 years, almost completely eradicating diseases such as smallpox and polio. Monoclonal antibodies target specific structures on cells to effectively and more safely treat cancer and autoimmune diseases. The first treatment with monoclonal antibodies was approved in 1986. That number has now swelled to more than 500 approved antibody treatments. These developments reveal the unique, innovative spirit of the healthcare sector.

With advances in digitization, quantum computing and AI, the pace of medical innovation is likely to continue to accelerate. Teresa explains the role of Rhenman & Partners is to identify and invest in these life-changing innovations while supporting their development and commercialization. Teresa concludes, “the future holds even more exciting possibilities, for improving global health”.

Having just landed from a global healthcare conference, portfolio manager Hugo Schmidt, who is responsible for investments within the Healthcare Services subsector, brought us all up to speed on the American elections and the ways in which they could affect the healthcare industry.

“I’m a bit jet-lagged from attending a conference in the US,” Hugo admitted, “where I discussed the impact of politics on healthcare with industry leaders such as Thermo Fisher’s CEO Marc Casper and United Health’s CEO Sir Andrew Witty.”

Hugo explains that the healthcare sector is inherently political and is one of the most regulated and controlled of all industries. He says healthcare also tends to be an important theme in the US elections citing Hillary Clinton’s and Donald Trump’s tweets in the 2016 presidential campaign. In this year’s elections, however, healthcare is not at the top of the political debate. Policy questions regarding tax reform, immigration, and foreign policy tend to dominate instead.

“With less focus on healthcare this election, a more stable future for the sector is anticipated.” – Hugo Schmidt, Portfolio Manager, Healthcare Services

Hugo noted that key political issues include the already passed Inflation Reduction Act, transparency in drug pricing, and funding for public healthcare programs. While reforms are ongoing, Hugo maintains that the industry is adapting well. “With less focus on healthcare this election, a more stable future for the sector is anticipated.”

Amennai Beyeen, Portfolio Manager responsible for the Biotech and Pharma subsectors, then shared his views on the different phases of investing by explaining the lifecycle of a medical product or company, which, from an investment perspective, typically spans about 15 years.

“We invest when sufficient patient data is available,” Amennai says, “which usually occurs during phase-2 trials. Approval often takes more than one year, followed by market speculation and competition. Continuous reassessment is essential as products mature, with investments growing as our confidence increases.”

“We invest when sufficient patient data is available, which usually occurs during phase-2 trials.” – Amennai Beyeen, Portfolio Manager, Biotech and Pharma

Amennai explained how market response and stock prices fluctuate once a trial is approved, which hype and competition often influences. Approximately only 10 percent of products reach approval, which then face commercial risks during launch. As products evolve and new data emerges, Rhenman & Partners’ investment strategy adapts to ensure alignment with market needs and opportunities. “This ongoing evaluation,” Amennai concluded, “helps us to better understand the complexities of the product lifecycle.”

Before heading off to the airport to attend a conference in the UK, Kaspar Hållsten, who is responsible for the Medtech subsector, shared a story of one particular portfolio company’s road to success.

“Over the past five years,” Kaspar explained, “the fund has experienced approximately 40 acquisitions, significantly boosting its performance.” As a stand-out example, he discussed the medtech company, Shockwave, which Rhenman & Partners has been following since 2019. “Despite initial uncertainties and market fluctuations,” Kaspar explained, “our early investment at around $35 per share resulted in a 10x return, culminating in Johnson & Johnson recent $13 billion acquisition.” This success highlights Rhenman & Partners’ rigorous investment process, extensive research, and long-term commitment.

“Nearly half of the fund’s performance comes from these companies,” he continued, “but we ensure companies can thrive independently, not just as acquisition targets.” Kaspar mentioned the strength of Rhenman & Partners’ Scientific Advisory Board and the diligent decision-making, which he attributes to the company’s past achievements and potential future success.

“Nearly half of the fund’s performance comes from these companies,” – Kaspar Hållsten, Portfolio Manager, Medtech

CIO Henrik Rhenman took to the stage with his signature brand of humor and humility explaining: “Over the past 15 years, our management journey has been both challenging and rewarding. We have faced numerous setbacks: from market downturns to global crises, but we have also had our share of successes. Looking back, I realize our memory tends to highlight the negatives, such as bad investments, while often forgetting the wins.”

Reflecting on some of what he calls his “biggest mistakes”, Henrik noticed a tendency to invest too little in high-performing companies and selling winners too early. He also admitted sometimes investing in riskier ventures when things are going well. Conversely, he has learned valuable lessons from setbacks, such as being patient and reducing holdings in struggling companies.

Henrik again attributed success in investing to having a collaborative team that can challenge each other and bring diverse perspectives. “Our team has grown stronger and more analytical, which is crucial as the sector is expanding and increasingly complex in nature. We are excited about the future, with a strengthened organization and a continued commitment to being one of the leading healthcare funds.”

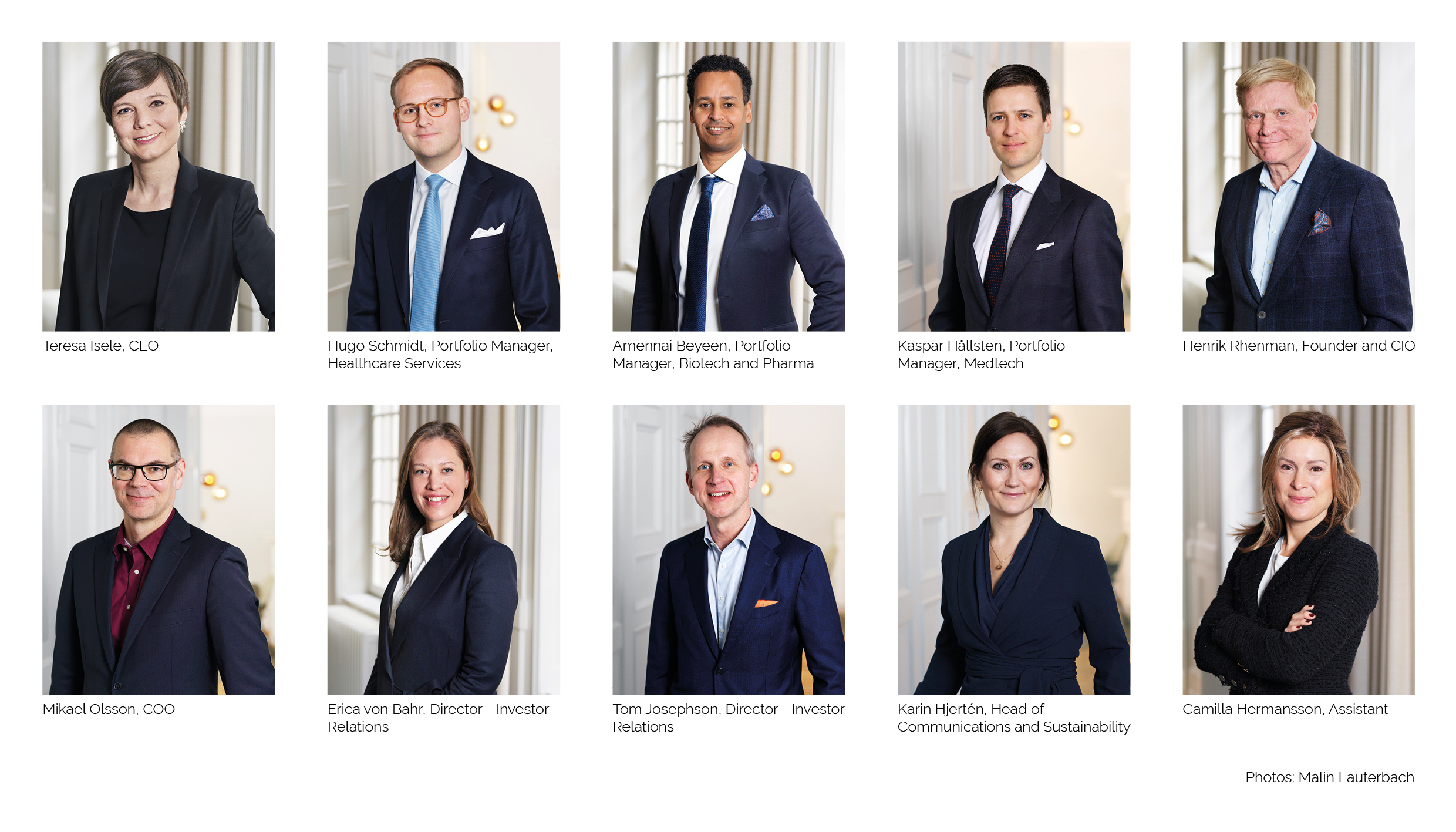

A highlight for the audience was when Henrik took the time to introduce and thank each employee who make up Team Rhenman 2.0 or Rhepa 2.0: CEO Teresa Isele, newly appointed COO Mikael Olsson, Portfolio Manager Kaspar Hållsten, Portfolio Manager Hugo Schmidt, Portfolio Manager Amennai Beyeen, Director of Investor Relations Erica von Bahr, Head of Communications and Sustainability Karin Hjertén, and Assistant Camilla Hermansson. Henrik also welcomed Tom Josephson to the team, Tom joins the firm as Director Investor Relations alongside Erica.

“Let’s keep moving forward together!” Henrik Rhenman, founder and CIO

The seminar culminated with a Question & Answer session where the audience was invited to participate. This clarified what is most important for Rhepa: using the team’s extensive knowledge and expertise to work for the benefit of current and future investors.

The mood was positive as people spilled out of the Grand Hotel into the sunshine that spring in Stockholm seems to promise this year with Henrik’s optimistic and resilient words still echoing in their ears: “Let’s keep moving forward together!”